In our June 2020 Bulletin number 002/ARB-BULLETIN/06/2020 we reviewed the quarterly financial performance of local professional reinsurance companies (IPR) for 2018 and 2019. Based on their latest published 1st Quarter 2020 results, this Bulletin attempts to further graphically depict the individual financial performance of IPR members, particularly in the wake of the Jakarta floods in early January 2020. In addition to the previous graphs covering:

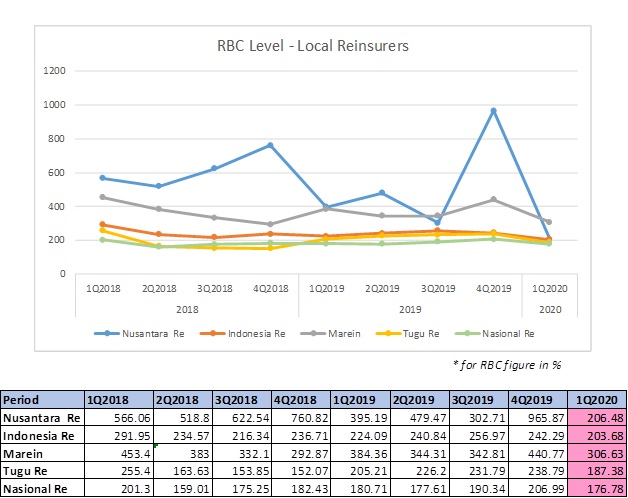

- Solvency or RBC Level

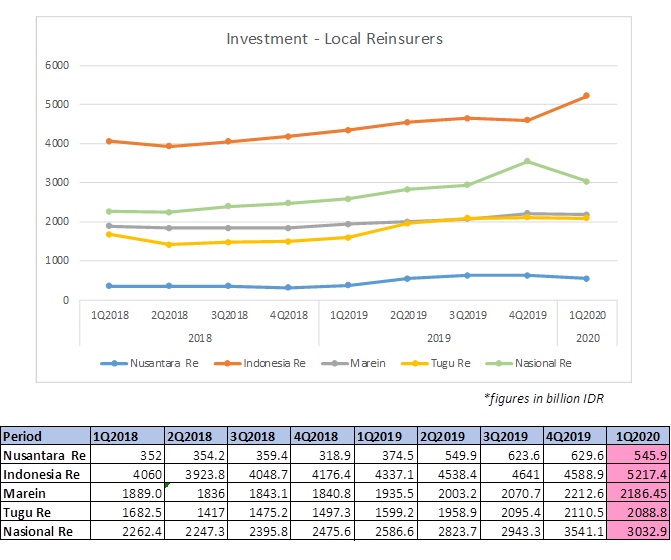

- Investment Funds

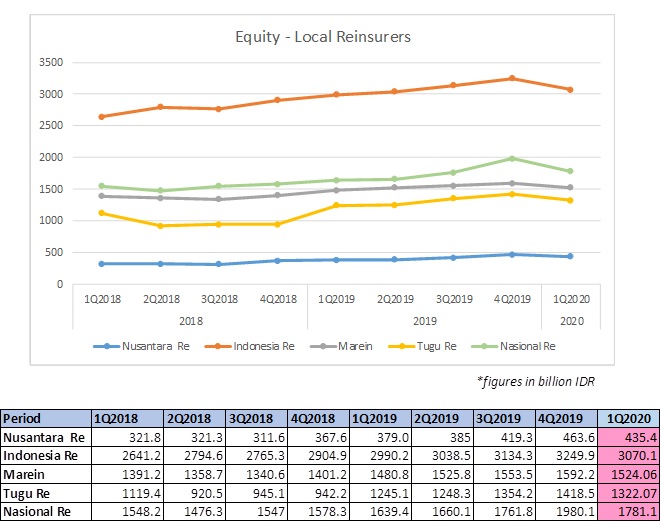

- Equity

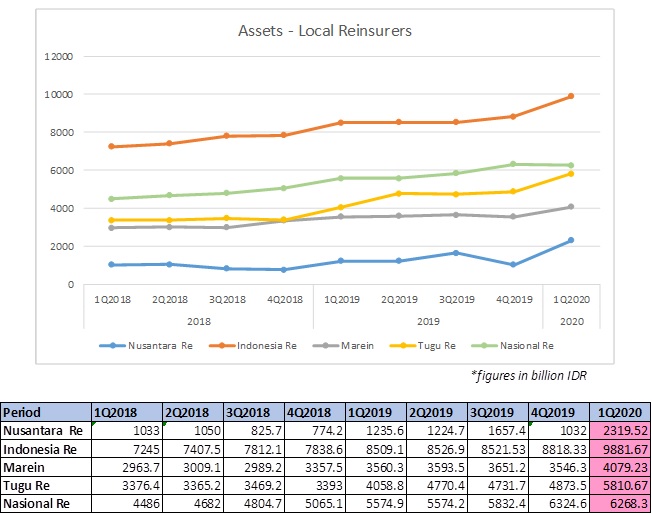

- Guarantee Funds or Assets.

we have added two new graphs covering IPR members’ Profitability and Liquidity ratios (measured as Assets / Liabilities) :

- Solvency or RBC Level

- Based on OJK regulation the minimum RBC level for a local reinsurance company is 120%.

- All local reinsurance companies in the panel comply with this requirement

- Investment Funds

- Equity

- Based on OJK regulation No 67/POJK.05/2016 the minimum equity for a local reinsurance company is IDR 300 Billion

- All local reinsurance companies in the panel comply with this requirement

- Guarantee Funds or Assets

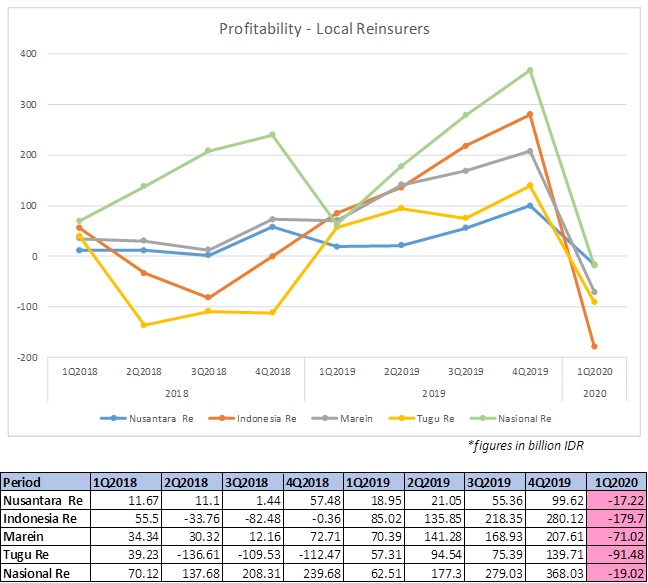

5. Profitability

6. Liquidity

If you have any issues on the above or on any other item please do not hesitate to contact:

Bernard Krova – el.krova@arbrokers.asia

Wayan Sumendra – wayan.sumendra@arbrokers.asia

Adia Adithiya – adia.pradithama@arbrokers.asia

To the extent this note expresses any opinion on any aspect of risk, the recipient acknowledges that any such assessment is an expression of PT Asia Reinsurance Brokers Indonesia’s opinion only, and is not a statement of fact. Any decision to rely on any such assessment of risk is entirely the responsibility of the recipient. PT Asia Reinsurance Brokers Indonesia will not in any event be responsible for any losses which may be incurred by any party as a result of any reliance placed on any such opinion.